Are you looking to sell or purchase an agency?

IIAT's free Matchmaker service can help put you in contact with sellers and prospective buyers.

Learn MorePowered by

The merger & acquisition environment is at an all time high. There are many factors that make Insurance agencies great investments, including: low interest rates, high retention rates and the increase of private equity in the industry. Multiples for well-run agencies are at an all time high.

Considering selling or acquiring and agency? There are many factors to consider to make a well-informed and sound business decision.

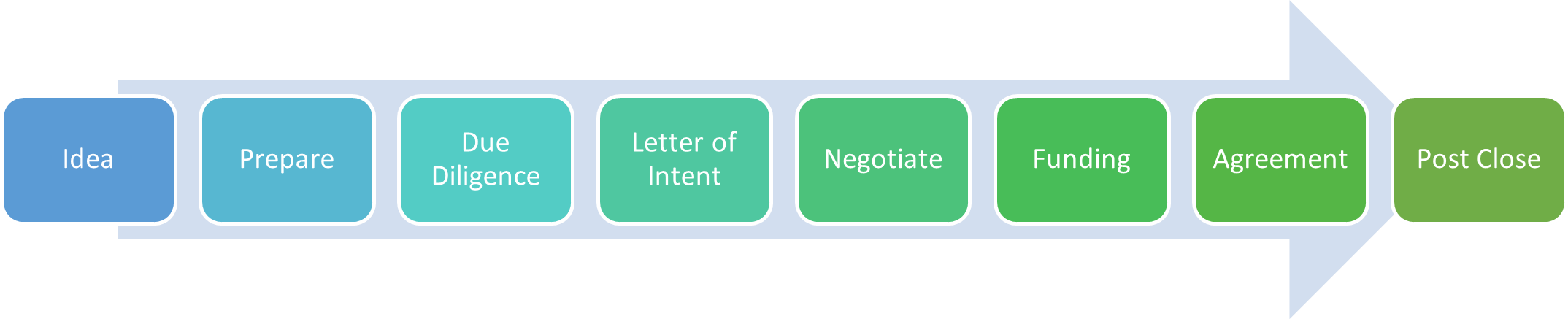

When you are contemplating a growth by acquisition strategy, selling your agency externally or transitioning the ownership of your agency internally, it is important for buyers and sellers to define their goals. There are many reasons that an agency owner wants to acquire or sell and knowing what is most important to you will help you define the path you want to take.

Common Reasons to Acquire

There are several terms like merger, asset purchase, book purchase, buy/sell agreement, earnout, multiples, Automatic ERP, ERP (Tail) and many others that are used when talking about mergers and acquisitions. Having a solid understanding of these terms is important to reduce confusion and make sure that everyone is on the same page.

Assess your own agency’s performance and readiness before exploring selling or bringing another agency into your operation. You should know your numbers, how they compare to industry benchmarks, understand your value and what is driving both your profitability and performance. Look at your legal agreements and be sure that you are well positioned and prepared. Knowing this information whether you are a buyer or seller will put you in a good position to define your needs and focus your next steps.

Identify Possible Opportunities

IIAT's Matchmaker service connects agencies that are interested in buying and selling together. Learn more.

Make sure that you have access to the right advice as you move through the process. For many, their agency is their biggest asset, so it is important that you are well-informed throughout the process. Your deal team should include a valuation expert, CPA/tax expert, lawyer and lender. It is important that these experts be well versed and experienced in the independent insurance industry.

Once you have found a prospective agency to buy, or a potential successor or buyer for your agency, it's time to conduct due diligence. You should act like a real investigator during this process. Your priorities will drive your decision about the potential opportunities. Prior to engaging in any conversation or exchanging any information sharing any information, you must execute an NDA. You can have a lawyer reach out to get the NDA in place to keep your agency’s name confidential.

Using all the information that you gathered during the earlier phases, you can now begin to map out the terms of an agreement. With the help of your deal team, you will first put a Letter of Intent in place and begin negotiating the terms of the agreement. This is where the valuation, tax considerations, legal implications and lending requirements will all be taken into consideration. Timing, mechanism, structure, and price can all vary depending on the buyers’ and sellers’ priorities and the synergies that exist. Having realistic expectations and understanding that all deals are unique is critical in this phase.

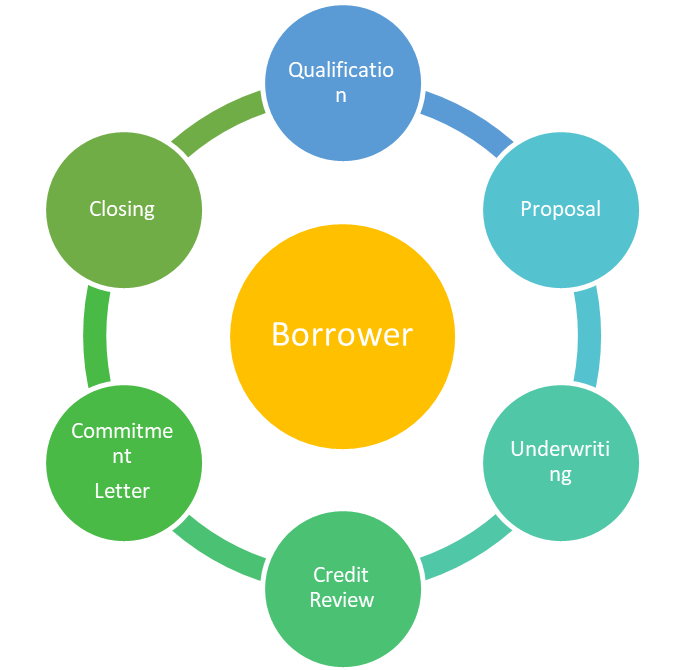

You should engage with a lender early in the process as they will require information about the agency and your personal financial situation. If you engage with your lender early you can gain an understanding of their process and timeline. They have their own qualification process and requirements that take time. Engaging too late with a lender can delay the process.

A strong agreement will include several key components that will protect the agency should anything unexpected happen to any parties of the agreement. Enlisting the help of your deal team will help ensure that your agreement is comprehensive and addresses all the key triggering events and clearly outlines the agreement that has been reached. In addition, there are several other agreements that may need to be put into place with both staff and owners as a condition of the agreement.

Once the deal has been executed the real work starts. Integrating two agencies and/or transitioning ownership requires thoughtful planning and strong communication. Deciding who will lead the agency, how to communicate to staff, customers, carriers, and agency partners throughout the process is very important. Listening to the concerns of all stakeholders throughout the transition process is important as your staff and your client relationships are key to the success of any deal.

IIAT's free Matchmaker service can help put you in contact with sellers and prospective buyers.

Learn More